Latest Statistics on Permanent & Temporary Recruitment JobsOutlook January 2024

As a professional recruitment agency, and member of The Recruitment & Employment Confederation, REC, Pursuit Resources Group are continually looking at the latest industry trends enabling us to support both our clients and candidates effectively.

JobsOutlook is a bi-monthly survey, conducted by REC, detailing hiring intentions by UK employers and features analysis of workforce demand and candidate shortages across all sectors. They use a range of sources including Labour Force Survey and Labour Market Overview, ONS publicly accessible data to build on their reports.

The survey includes original data from over 500 employers per quarter, about their hiring plans, in the short and medium-term for hiring permanent and temporary staff.

UK Employer confidence hiring and investment trends

Throughout Q4 in 2023, business confidence in the UK economy fell by four points to net: -43* which was driven by a notable drop in the balance of sentiment in December. Employer’s confidence in making investment and hiring decisions also deteriorated, and was offset by a much greater pessimism in December.

Positive permanent recruitment outlook within the next three months

UK-wide employer sentiment towards short-term permanent hiring remained strong in Q4. Optimism in the North was higher on average than London and there was a much higher level of optimism in the public sector (net+22)* than the private (net:+14)*. Medium sized businesses 50-249 employees) were notably more positive than either micro/small (0-49 employee) or large (250+ employee) at +11 and net:16*, respectively.

Hiring intentions remain positive within the next 12 months

Medium-term permanent hirings remained strong this quarter (at net: +23)**. Regionally, sentiment remained buoyant in the North (at net:+30)**. In contrast, demand in London continued to weaken, whilst still in the positive net: +12 from +27** in the summer (June-August 2023) the lowest of all regions.

Labour Market Dashboard

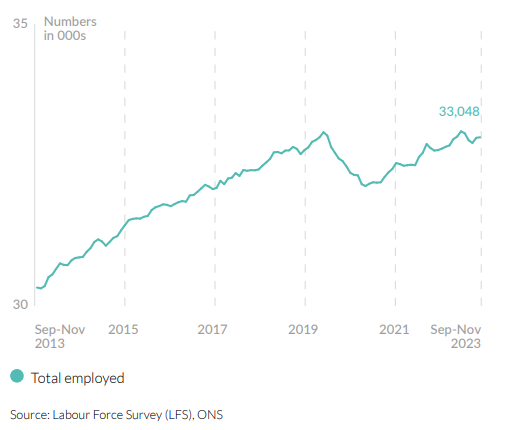

The Labour Force Survey, ONS, reported that between September-November 2023 the total employment figures reached 33.05 million in the UK, and the number of people in employment across the UK was 0.2%. This was higher than the preceding quarter (June-August) and up 0.8% year on year, however the official vacancy count registered its nineteenth consecutive rolling-quarterly fall in October-December. Overall levels remained at 16.6% (133,000) higher than pre-pandemic Q1 2020 levels.

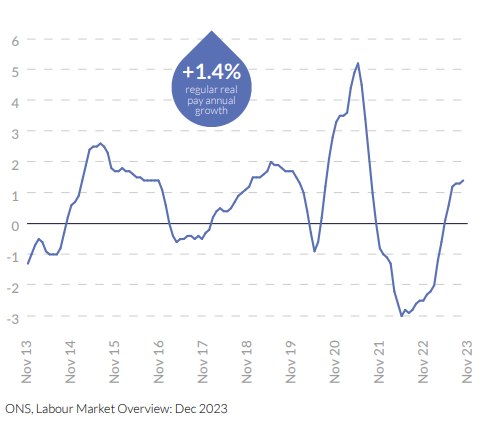

Real Wage Growth back in positive territory since June 2023

As per the ONS: Labour Market Overview: Dec 2023 at 6.6%*** in three months to November 2023, the annual growth in national average pay (excluding bonuses) was down from the preceding three months in August 2023 at 7.9%.

This is likely due to inflation levels (CPI) levels reducing the pressure on employers to raise wages. Inflation dropped from 6.7% in September to 4.6% in October and further to 3.9% in November. Real terms regular wage growth is back in positive territory since the three months to June 2023.

If you would like to discuss this in further detail with us, or would like to speak to our experienced recruitment consultants about your recruitment business needs, please contact us on 01245 362500 info@pursuitgroup.co.uk